Get the free the following federal tax table is for biweekly earnings of a single person a 9 column table with 7 rows is shown column 1 is labeled if the wages are at least with entries 720 740 760 780 800 820 840 column 2 is labeled but less than with entrie

Show details

Payment is electronically loaded onto a plastic card Characteristics Most common payment method Least secure payment method because the employee is responsible for taking the check to the financial institution and depositing it into his/her personal account On payday the employee receives a written statement detailing the paycheck deductions More secure form of payment because there is no direct handling of the check Protection Regulation E Electronic Fund Transfer Act protects cardholders...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign use the following federal tax table for biweekly gross earnings of a single person to help answer the question below a 9 column table with 7 rows is shown column 1 is labeled if the wages are at least with entries 720 740 760 780 800 820 840 colu form

Edit your use the tax table to help answer the following question a 9 column table with 7 rows is shown column 1 is labeled if the wages are at least with entries 720 740 760 780 800 820 840 column 2 is labeled but less than with entries 740 760 780 800 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your the chart shows a sample paycheck stub a 2 column table has 6 rows the first column has entries salary federal income tax social security tax medicare tax state income tax and net pay the second column has entries 1106 45 122 67 68 60 16 04 10 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit the following federal tax table is for biweekly earnings of a single person a 9 column table with 7 rows is shown column 1 is labeled if the wages are at least with entries 720 740 760 780 800 820 840 column 2 is labeled but less than with entries online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit use the following federal tax table for biweekly earnings of a single person to help answer the question below a 9 column table with 7 rows is shown column 1 is labeled if the wages are at least with entries 720 740 760 780 800 820 840 column 2 is form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

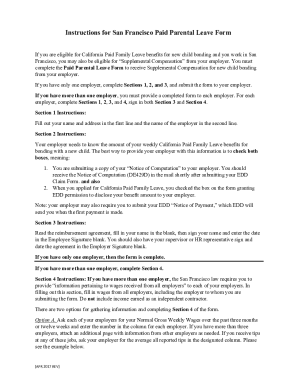

How to fill out understanding your paycheck worksheet answer key form

How to fill out understanding your paycheck worksheet:

01

Gather your pay stubs: Collect all of your pay stubs for the relevant time period.

02

Identify the key information: Look for important details such as your gross pay, deductions, and net pay.

03

Calculate your gross pay: Add up all of your earnings before any deductions are taken out.

04

Deductions: Identify and record any deductions that are taken from your gross pay, such as taxes, insurance premiums, or retirement contributions.

05

Calculate your net pay: Subtract the total deductions from your gross pay to determine your net pay.

06

Record additional income: If you have any additional sources of income, make sure to include those in your worksheet.

07

Analyze the information: Go through the worksheet and analyze the breakdown of your income, deductions, and net pay.

08

Review for accuracy: Double-check all of the calculations and ensure that the information on the worksheet is accurate.

09

Make note of any questions or concerns: If you have any questions or concerns about your paycheck, jot them down on the worksheet for future reference.

Who needs understanding your paycheck worksheet:

01

Individuals who receive a paycheck: Anyone who receives a regular paycheck can benefit from using a paycheck worksheet.

02

Employees who want to track their income: If you want to keep track of how much you earn and where your money is going, a paycheck worksheet can be useful.

03

People who want to budget effectively: Understanding the breakdown of your income and deductions can help you create an effective budget and manage your finances better.

Fill

understanding your pay stub worksheet answer key

: Try Risk Free

People Also Ask about use the following federal tax table for biweekly gross earnings of a single person to help answer the question below a 9 column table with 7 rows is shown column 1 is labeled if the wages are at least with entries 720 740 760 780 800 820 840 colum

What was Julie's gross pay for this pay period?

What was Julie's gross pay for this pay period? $360 What was her net pay? $310.95 Why is her net pay less than her gross pay? Withholdings and deductions were taken out of Julie's gross pay in the amount of $49.05, leaving $310.95 for her net pay.

How do I maximize my take-home pay on w4?

You can raise your take-home pay by simply increasing the number of allowances on the tax form you fill out at work. This doesn't change your total tax burden, just the amount that is withheld each pay period. The more allowances you claim, the less federal income tax your employer will withhold.

How can I maximize my take home pay?

5 Ways to Keep More of Your Paycheck Adjust your tax withholding. Do the math. Update your 401(k) contributions. Employee benefits. Revisit your paycheck deductions.

Is it better to claim 1 or 0 on your taxes?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

How do paychecks work?

A paycheck is a check that an employee is given as payment for services rendered. The employee then cashes the check to receive the money. The employee also could elect to have the paycheck directly deposited into their bank account, so their pay shows up automatically on payday.

What does Medi mean on my paycheck?

Reflects the employee-paid federal, state, and social security taxes. Social Security Tax is broken out into two components: Fed Med EE is the Medicare portion, and Fed OASDI/EE represents the Old Age, Survivors, and Disability Insurance Portion.

When should I expect my first paycheck?

Payroll checks may be issued at the end of each pay period worked, or there may be a lag and your paycheck may be issued a week or two (or longer) after you begin work. At the latest, you should be paid by the company's regular pay date for the first pay period that you worked.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find pay stub practice worksheet answers?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific a 3 column table has 6 rows the first column has entries gross income federal tax state tax local tax total deductions and net income the second column is labeled withholdings with entries blank 16 dollars 3 dollars 2 dollars and 50 cents 22 do and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I make changes in use the tax table below to answer the following question a 9 column table with 7 rows is shown column 1 is labeled if the wages are at least with entries 720 740 760 780 800 820 840 column 2 is labeled but less than with entries 740 760 780 80?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your understanding your pay stub practice answer key to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an eSignature for the understanding your paycheck worksheet in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your the ways we are paid worksheet answers directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is understanding your paycheck worksheet?

The understanding your paycheck worksheet is a tool designed to help employees comprehend the various components of their paycheck, including deductions, withholdings, and net pay.

Who is required to file understanding your paycheck worksheet?

Generally, all employees who receive a paycheck may benefit from using the understanding your paycheck worksheet, but it is particularly useful for those who want to understand their earnings and deductions more clearly.

How to fill out understanding your paycheck worksheet?

To fill out the understanding your paycheck worksheet, employees should gather their pay stubs, carefully record their earnings, deductions, and any other relevant information, and use the provided fields to calculate their net pay.

What is the purpose of understanding your paycheck worksheet?

The purpose of the understanding your paycheck worksheet is to provide employees with clarity on how their gross pay is affected by various deductions, helping them to better manage their finances and plan for taxes.

What information must be reported on understanding your paycheck worksheet?

The understanding your paycheck worksheet must report information such as gross pay, federal and state tax withholdings, Social Security and Medicare contributions, other deductions, and the final net pay.

Fill out your form following federal tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pay Stub Scavenger Hunt Answer Key is not the form you're looking for?Search for another form here.

Keywords relevant to paycheck worksheet pdf

Related to reading a paycheck stub worksheet

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.